Tell me where I’m going to go to die and I won’t go there.” – Charlie Munger

Not to be morbid, but this is a real thing. By thinking about where you don’t want to go, you’ll identify the problems that will get you where you don’t want to go. What Charlie is getting at here is something called “Inverse Thinking,” and it can dramatically change your business.

During the most recent War Room Intensive, “Leverage, Exit, Grow, & Scale,” Roland Frasier broke this down to a handful of members and how to implement it into their business right away. What’s more, he provided some all too familiar examples of how Inverse Thinking has paved paths of ultimate success, and when a lack of it has led to quite the downfall.

(NOTE: Roland’s Leverage, Exit, Grow, & Scale Intensive was such a hit, we’ve added THREE more of these intimate workshops in 2019. We have a few spots left for qualified business owners in August, September, & December. Let us know if you’re interested and the links above have additional information on each.)

No Revenue? No Problem?

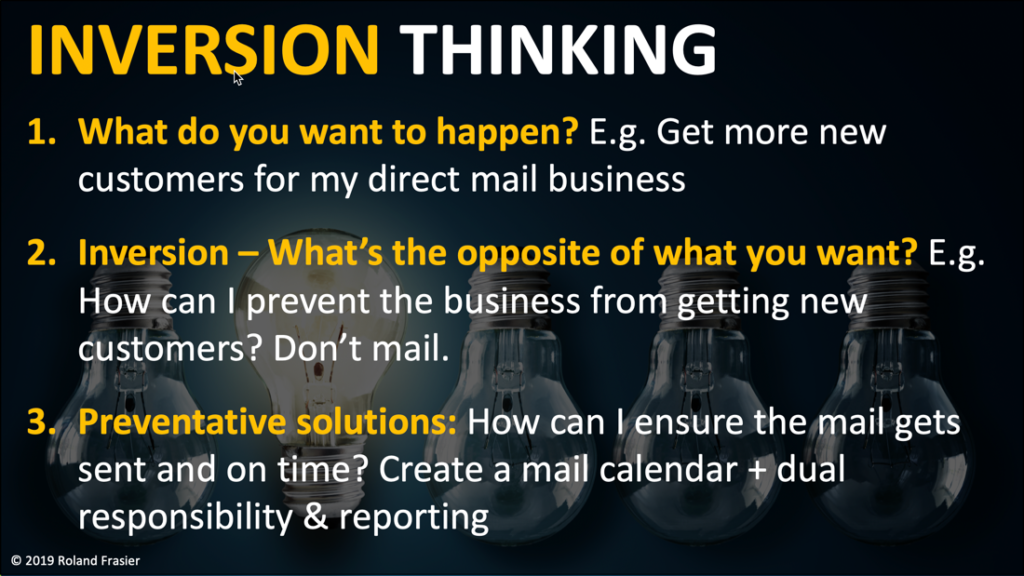

Roland guided us through a journey where Inverse Thinking would have saved a ton of money, and most importantly a ton of time, inside his direct mail company. The business was going through a rough patch–revenue was down and the team was out of ideas.

The two largest areas of costs for direct mail is obviously printing & postage. Therefore, to cut costs, the team decided to stop mailing for a period of time.

It actually worked, sort of. But not really.

Initially, costs fell and revenue was generated due to all the millions of pieces of mail already in circulation. But eventually, that dried up and they were performing worse than before the production shift.

These things can happen, even in this extreme example But could have been prevented by incorporating the practice of Inverse Thinking…

The image above is from the slide deck used throughout this intensive and as an illustration for this specific example.

Roland’s direct mail team could have utilized this three question series to avoid this problem by starting in reverse.

Instead of creating an immediate solution to fix the problem, they learned to start with preventive solutions first. It’s vital to not only stop the slow bleed, but assure the system is stitched up so it won’t happen again.

(NOTE: the full clip in the video above expands on 3 more examples and additional information on how to incorporate this type of practice into your systems.)

Eyjafjallajokull + 7 Figures

No, that’s not a typo.

This is the name of a volcano that erupted about 10 years ago, shutting down all travel for two weeks. Coincidentally, Roland happened to be vacationing Italy at the time.

With no way to return home, Roland goes on to explain how Inverse Thinking turned a disaster into a fantastic success story.

Instead of standing pat and waiting weeks for the next flight out, he decided to find a way to try a product launch.

Due to ample experience in the market, Roland’s previous assumptions were it would require to either have a product or build a list by investing a hefty sum of money into it.

Instead of running either of those notions, he ended up earning $1,265,000 on a $1,250 investment…

By spending a few full days pressing into every scenario launching a product could be effective, Roland was able to 1012X the investment selling a product called “Mainstreet Marketing Machine.”

It’s amazing what you can accomplish if you just have the time to do it.

One Core Idea

These two examples show both ends of the spectrum. But they illuminate one core idea:

In every decision, identify what the opposite of what you want is in every situation and work backwards from there.

The practice of Inversion Thinking will change your business, your personal life, and even make you a few extra bucks along the way (or millions).

If you thought this was interesting, we have MUCH more for you…

Interested in War Room? See if you qualify by clicking the button above.