How can you acquire an ownership interest in someone else’s business when you are bringing non-cash assets like your knowledge or time to the deal?

How do you structure a deal to let someone else into your existing business as an equity owner when they don’t have cash but do have something else that’s valuable to your company that you want?

We have done several deals including a recent one like this. So I thought I would share one approach that comprises 6 key deal points to remember:

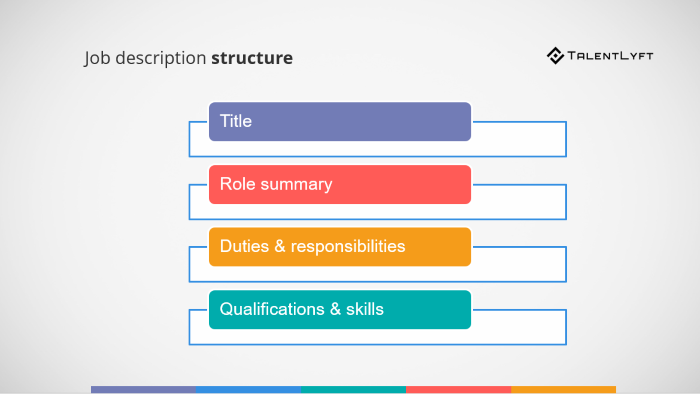

1. Who’s Involved?

What are the roles of each party? Don’t skip details here, not even seemingly minor ones. Think this as LinkedIn, but for this specific deal. Make sure to include full:

- Job Titles

- Descriptions

- Employment Agreements

2. Detailed Compensation Package Deal Points

Everything needs to be listed and detailed here. Don’t leave anything you know of now to chance and make sure nothing is ambiguous in the compensation package.

If the percentage is to be determined later, be sure to include what it will be based off of and what parties will be involved in making that decision.

This may sound obvious, but you’d be surprised how many deals don’t do this correctly.

Here’s an example of something we just recently drew up for our last deal:

- Buy-in for immediate equity + performance-based increases of up to 10%

- Additional vesting 2.5% per year for four years (time-based component)

- Plus performance milestones based on revenue (performance-based component)

3. Have a Breakup Clause

Everything’s great, until it isn’t…

It’s important to provide for what happens if things do not work out, so you’ll need to build a breakup clause into the agreement.

In our case, if the other party leaves the business or is terminated, we have the right to buy them out on a pre-agreed valuation formula with pre-agreed terms

4. Pre-Agreed Buy-In is Also a Must

You need to agree on valuation for the buy-in as well. Usually this is done on an EBITDA basis (earnings before interest, taxes, depreciation and amortization) where valuation equals EBITDA multiplied by an industry typical multiple.

Here’s an example of a pre-agreed buy-in using EBITDA:

Let’s say the business is earning $1M in profits and you agree on a multiple of five, then the valuation equals $50, a 20% buy-in would be $1M (or 20% of $5M).

5. What if the Value is Intangible, AKA Not Cash?

If the buy-in is not for money, but for some additional value they’re supposed to provide, you’ll need to place a value on those non-cash components too.

Here’s how you can do just that:

In this example, the other party’s value is their book of business (much like our most recent deal I mentioned above).

You operate at a margin of 30% profit and the other party’s book of business, or the things they’re contributing are expected to be worth $1M per year, then the first-year value would be 30% of $1M, or $300k.

If the average lifetime customer value (LTV) is 3 years, then the total value the other party’s bringing would be expected to be worth $300k at 3 years, or $900k in LTV.

Additionally, if your company valuation is $1.8M, then the other party’s book of business would be worth an estimated increase in value of 33%.

$1.8M + $900k = $2.7M divided by $900k = 33%

So, if it goes as you expect, then the other party would receive 33% equity of the agency for bringing these assets/accounts (their book of business).

6. Adjusting for Change Throughout

It’s vital to include language in the deal that adjusts the other party’s equity (continuing the example in #5) based on any variance between what you both thought the value of the book of business (or what they’re bringing to the table) compared what it ACTUALLY is over time.

Hint: We want to be the teddy bear Leonardo DiCaprio, not “The Reverent” Leonardo DiCaprio (though he did finally win that Oscar… but still)

Here’s how I would contractually adjust for change:

Scenario: after 3 years, the other party’s book of business only turned out to be worth $720k, which is 20% less than the $900k you expected.

Then a fair agreement would be to decrease the other party’s 33% equity to 20%, leaving them with 25.5% of the business instead of 33%.

Final Note:

There are lots of tax issues that come into play here as well as other deal points; therefore, always be sure to secure a successful attorney and advisor to help document and negotiate the deal.

There’s tons of ways to do these deals, so if you have any specific questions feel free to ask in the comments or find me on Instagram (@rolandfrasier), my DM’s are open.

– Roland

If you thought this was interesting, we have MUCH more for you…

Interested in War Room? See if you qualify by clicking the button above.